CMS Releases NGHP Section 111 User Guide Version 7.4 and Top Ten Reporting Errors from 2023

Last Updated: 01 Feb 2024

Author: Logan Pry

CMS has released its first version of the Non-Group Health Plan Section 111 Reporting User Guide of 2024. Not long after a recent informational webinar regarding Civil Monetary Penalties held on January 18, CMS released version 7.4 of the User Guide, in which the primary update is the addition of Ch. III, sect. 5.1 - Civil Monetary Penalties. This addition does not contain any surprise details that were not a part of the informational webinar, or prior communications regarding CMPs, but rather provides a general overview of what may subject an RRE to penalties, when, and how, as well as a description of CMS’ audit methodology. The full update can be found here - https://www.cms.gov/medicare/coordination-benefits-recovery/mandatory-insurer-reporting/user-guide. However, a brief summary of the additions outlined in section 5.1 are:

- RREs that fail to comply with the Section 111 reporting requirements may be subject to a CMP of up to $1000 (adjusted for inflation) for each day of noncompliance.

- The regulations outlining this authority are effective as of 12/11/2023 and will be applied to RREs beginning 10/11/2024.

- CMS will select a randomized sample of 250 new MSP ‘occurrences’ each quarter and audit these occurrences to determine whether RREs have complied with the reporting requirements.

- RREs must report within one year of the date of incident, when ongoing responsibility for medicals (ORM) is assumed; or within one year of the TPOC date to be considered compliant.

- The occurrences to be audited will include both Section 111 submissions and records from sources outside of the Section 111 reporting process, to ensure that CMS does not miss those situations where an RRE has entirely failed to report the occurrence.

- RREs will only be informed when there is a potential instance of non-compliance.

- RREs will be notified of potential non-compliance by CMS and afforded the opportunity to present information that demonstrates that the RRE was actually compliant.

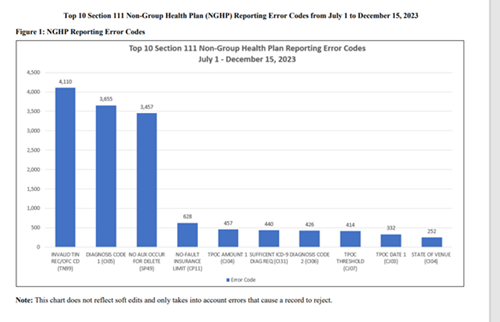

Of note, CMS indicates that the information relevant to respond to, or otherwise defend against, a potential CMP will vary, but may not include situations where the RRE submitted records that CMS was unable to process due to errors in the claim input file. Directly in line with this, last week, CMS also released the top ten reporting errors received by NHGP RREs between July 2023 – December 2023. A snapshot of the top ten is:

The top three errors here include reporting under an invalid TIN or office code, reporting an invalid ICD code 1, and reporting erroneous ‘delete’ records. While RREs should ensure that their entire claim input file is accurate and error-free to ensure the record is accepted and you avoid CMPs, fields including ICD codes, ORM, and TPOC information are also of particular interest as they can have a direct impact on your conditional payment resolution process.

Given the information that we know about future CMPs and the start date of October 2024, now is as good of a time as any to ensure that your Section 111 Reporting program is fully compliant and ORM and TPOC occurrences are being reported in a timely manner. An internal review of your current reporting processes to diagnose any shortcomings is a great place to start. For questions about these updates, as well as general inquiries about Section 111 Reporting please contact us at info@allankoba.com.

Other Blogs

- Double the Damages, Double the Motion, Double the Denial

- Section 111 Compliance Update

- MSP Admissions Questionnaire and it's impact on the MSP system overall...

- This is not a bill: NC District Court Addresses Ripeness

- CMS UPDATE: New Section 111 User Guide Released with PAID Act Information

- Wait for it ... Again: LMSA Rules in October?

- Section 111 Reporting Update

- 2022: LMSA Pushed to February, $750 Threshold Remains

- CMS Discredits Non-Submits in WCMSA Reference Guide Version 3.5

- CMS Launches 'Go Paperless' Option for MSPRP Account Holders

Contact Us

64 Danbury Road

Suite 201

Wilton

CT 06897

Tel: +1 267 857 0544

For more information please email info@allankoba.com

To refer a file please email referrals@allankoba.com