CMS has finalized what will arguably be the most significant rulemaking the Medicare Secondary Payer industry has ever had. The final rule specifies how and when Group Health Plan and Non-Group Health Plan reporting entities will be penalized civilly for failure to comply with Section 111 reporting requirements. A high-level outline of the highlights of this rule as it applies to Non-Group Health Plans (NGHPs) and the impact to the carrier community can be found below. To read the full text of the final rule, click here.

To discuss this rule in more detail with a member of the Allan Koba Compliance Section 111 Reporting Team, please email info@allankoba.com and we will be happy to schedule a meeting.

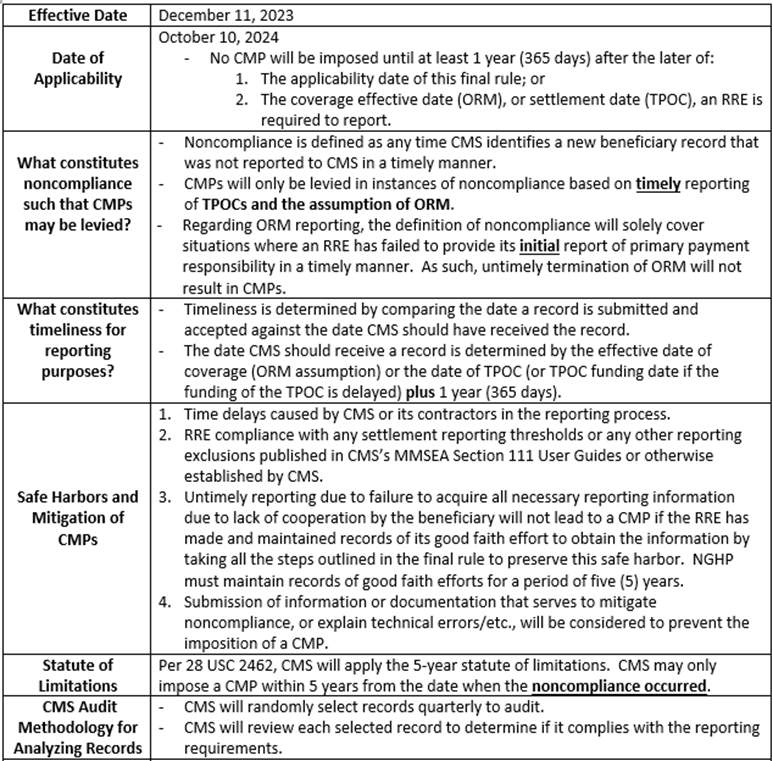

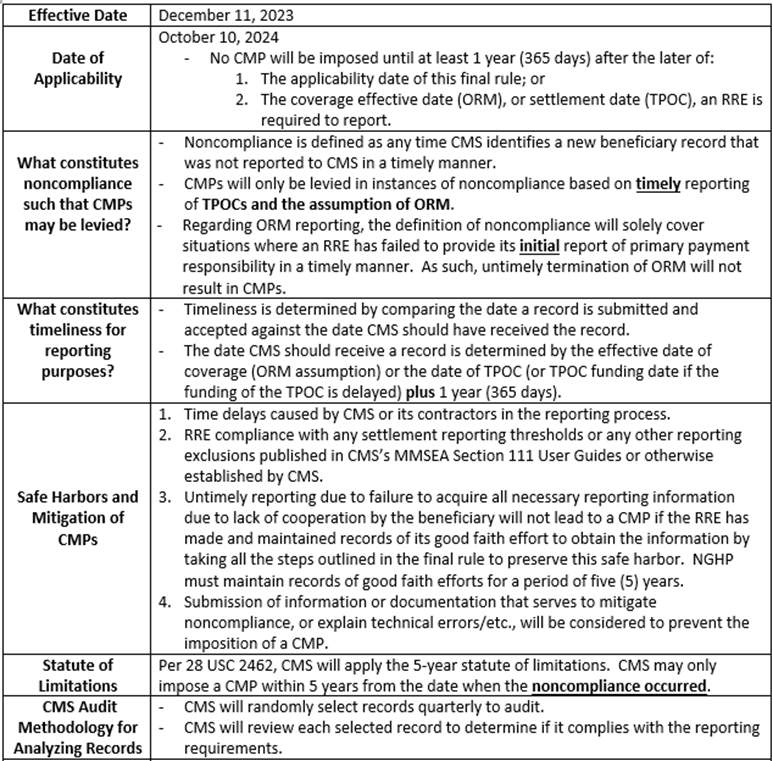

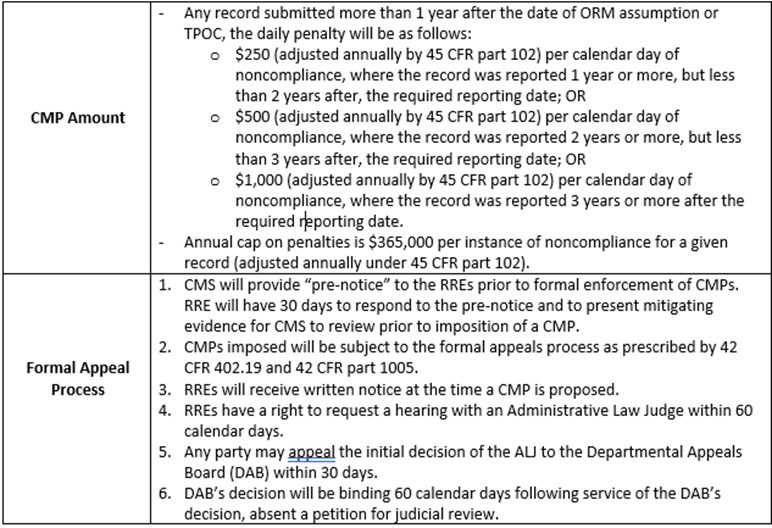

Overview of the Final Rule on Section 111 Civil Monetary Penalties (CMPs) for NGHPs:

Commencing October 2, 2023, the new maximum settlement amount for the Fixed Percentage Option (FPO) will be $10,000. This is double the current maximum settlement amount for the FPO of $5,000.

The function of a FPO in Medicare conditional payments cases is that it streamlines the process for handling monies owed to Medicare. When a liability or workers’ compensation case settles and certain criteria is met, the beneficiary, the beneficiary’s attorney, or other representative can make a request that a Medicare conditional payments lien be calculated using the FPO. When electing to proceed with the FPO, Medicare’s recovery claim can be resolved by paying Medicare 25% of the gross total settlement, as opposed to utilizing the traditional Medicare conditional payments recovery process. Please note the gross settlement is not reduced for attorney’s fees and costs. By electing to use the FPO and pay Medicare 25% of the gross total settlement, this simplifies the Medicare conditional payments process and saves the parties’ time and resources.

Pursuant to the Centers for Medicare and Medicaid Services (CMS), to qualify for the FPO, all the following criteria must be met:

A written request for a FPO must be made to CMS. Upon receipt of the written request, CMS will decide whether the FPO will be allowed within 30 days. If the request for FPO is approved, payment must be made to CMS by a date certain that will be indicated on the approval letter. If the request for FPO is not approved, the parties will need to handle Medicare conditional payments via the traditional recovery process. It is important to note that if a FPO is elected, the beneficiary may not subsequently seek an appeal.

For questions about these updates, as well as general inquiries about Section 111 reporting and all things Medicare Secondary Payer, please contact us at info@allankoba.com.

CMS has continued the recent onslaught of Section 111 Reporting updates with the release of the latest iteration of the Non-Group Health Plan User Guide – Version 7.3. Given other recent updates, alerts, and townhall conferences held, this does not come as a surprise. Version 7.3 contains three main revisions:

First, and arguably the most significant, Ch. III has been updated to attempt to add some detail to the section on Ongoing Responsibility for Medical (ORM) reporting – Section 6.3. These changes aim to clarify what triggers ORM. In a prior update, this section was expanded, adding a conjunctive, 2-part test for the trigger of ORM. That is, in Version 7.2, the trigger for ORM was the assumption of ORM by the RRE AND the beneficiary receiving medical treatment for the related injury. This update caused questions from our industry, including how and when an RRE should know about medical treatment. In response to these questions, the agency has released the updates of Version 7.3 which has removed use of the word “and”, applying a new definition which now states that the trigger for ORM reporting is the determination to assume ORM which is when the RRE learns, through normal due diligence, that the beneficiary has received claim-related treatment.

These changes to the text effectively remove the decision-making power from the RRE to decide when ORM has been accepted, and has defined acceptance as knowledge of claim-related treatment. That surely cannot be the intent of CMS here and I anticipate additional updates to follow. As an example, under this text, an RRE would be assuming ORM if they learn of treatment, through normal due diligence, in a denied claim. A case in which ORM would normally not be reported.

For comparison, the language of Section 6.3 now reads as follows:

| Version 7.2 | Version 7.3 |

| The trigger for reporting ORM is the assumption of ORM by the RRE, which is when the RRE has made a determination to assume responsibility for ORM and when the beneficiary receives medical treatment related to the injury or illness. Medical payments do not actually have to be paid, nor does a claim need to be submitted, for ORM reporting to be required | The trigger for reporting ORM is the determination to assume ORM by the RRE, which is when the RRE learns, through normal due diligence, that the beneficiary has received (or is receiving) medical treatment related to the injury or illness sustained. Required reporting of ORM by the RRE does not necessarily require the RRE to have made payment for Medicare-covered items or services when the RRE assumed ORM, nor does a provider or supplier necessarily have to have submitted a claim for such items or services to the RRE for the RRE to assume ORM. |

Second, Ch. IV has been updated to inform users who have opted into the unsolicited response file process that they may receive an empty file if no updates were made to their records in a given reporting period. That is, if an RRE has opted to receive the unsolicited response file, it will still receive a blank response file if no updates have been made by outside parties that would/should be contained therein. While the issuance of empty unsolicited response files was previously announced via an Alert last month, the fact that an empty file may be received is now outlined in Ch. IV, Sect. 7.5 for future reference.

Finally, so long, Internet Explorer. Chapters I, II, and IV have been revised to remove all references to Internet Explorer as it is no longer a supported browser. While this update likely does not make too many waves, it may be of interest to some carriers utilizing a reporting software that was designed for IE.

Each chapter of the updated User Guide, Version 7.3 is available for download here – https://www.cms.gov/medicare/coordination-of-benefits-and-recovery/mandatory-insurer-reporting-for-non-group-health-plans/nghp-user-guide/nghp-user-guide.

For questions about these updates, as well as general inquiries about Section 111 reporting and all things Medicare Secondary Payer, please contact us at info@allankoba.com.

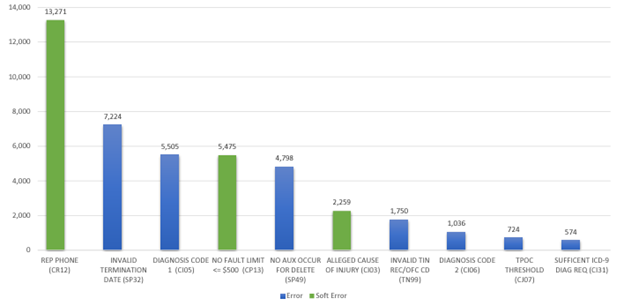

CMS has recently published an updated list of the Top 10 Section 111 NGHP Reporting error codes. This list is based on data received from January 1, 2023 through June 30, 2023. While the full breakdown can be found here – https://www.cms.gov/medicare/coordination-of-benefits-and-recovery/mandatory-insurer-reporting-for-non-group-health-plans/whats-new/whats-new. A snapshot of the top 10 errors is as follows:

While three of the top ten errors are “soft errors” and will not trigger an error threshold kickback as a result, of interest are a few of the top vote getters; namely, invalid Termination Date and Invalid Diagnosis Code 1. While RREs should ensure that their entire claim input file is accurate and error-free, these fields may be of particular interest as they can have a direct impact on your conditional payment recovery activity. Not properly terminating ORM when applicable, as well as improper coding can leave an RRE with an uphill battle when disputing conditional payment demands.

CMS last published this list in January for data collected for the previous 6-month period of July 1, 2022, through December 31, 2022. The new data set shows an increase of total number of errors received among the top 10 (an increase of about 39,500 errors to 42,600 through 6 months this year) as well as a shift in the errors making the top 10 list.

CMS also recently pushed an alert indicating that they have received questions regarding empty unsolicited response files. Within this alert, the agency has confirmed that if an RRE has opted in to the Unsolicited Repose file receipt, they will always receive a file in return and in the event that there are no records updated by an outside source to be included one the unsolicited response file, then it will be blank. This alert also indicates that the NGHP User Guide will be updated to clarify and confirm that RREs will receive blank response files if there is no data to update.

For questions about these updates, as well as general inquiries about Section 111 reporting and Medicare recovery correspondence, please contact us at info@allankoba.com.

Practice Alert!

Effective March 13, 2023, the Centers for Medicare and Medicaid Services has issued an announcement that the mailing address has changed for Medicare’s Commercial Repayment Center (CRC). The CRC handles all liens for cases wherein Medicare considers the insurer/employer to be the debtor.

Please note the new mailing address for Group Health Plans and Non-Group Health Plans is as follows:

Medicare Commercial Repayment Center – GHP

P.O. Box 680

Lathrop, CA 95330

And

Medicare Commercial Repayment Center – NGHP

P.O. Box 1610

Lathrop, CA 95330

Allan Koba recommends sending all correspondence, including but not limited to, Medicare conditional payments disputes and letters of authority, as well as any lien payments, to the address noted above effective immediately. As always, please don’t hesitate to contact Allan Koba for any lien related Medicare needs at Info@AllanKoba.com.

Non-Group Health Plan reporting entities have been waiting for over a decade for clarification on when and how civil monetary penalties (CMPs) for non-compliance with the Section 111 reporting guidelines will be assessed. The proposed rule that will specify how and when CMS must calculate and impose CMPs was published on February 18, 2020 and can be reviewed here. On February 17, 2023, CMS announced that they will be extending the time for publication of the final rule. In sum, it was noted that additional data analysis and predictive modeling need to be done to better understand the economic impact of the rule on different insurer types. The official announcement for the delay will be published in the Federal Registrar on February 22, 2023.

This undoubtedly allowed RREs to take a breath and focus on continuing to improve and streamline processes to ensure they are compliant. It is a relief that there has been an acknowledgement of how grave the potential economic impact could be if the max penalties were to be imposed. For illustrative purposes, imagine if an RRE failed to report 100 claims for a period of 90 days. The proposed penalty could reach a staggering $9,000,000 without even accounting for the inflationary daily penalty which would be closer to $1,200 per day per claim. As we pointed out when we commented on the proposed rule, the penalty does not fit the “crime”. A more logical and balanced approach to penalties needs to be considered. Possibly something that takes in to account the amount of conditional payments Medicare made during the period of non-compliance, the amount CMS will need to spend to investigate and recover for non-compliance, the overall good faith effort to comply the RRE has exhibited despite the failure to comply on certain cases, etc. It should be noted that an additional comment period is not on the table; however, it is encouraging that CMS is delaying the promulgation of a final rule to consider more thoroughly how this will impact all carriers in light of the original comments submitted last year.

With this new timeframe in mind, it is important for responsible reporting entities to pay close attention to any guidance that CMS distributes and take this extra year to implement any necessary improvements to Section 111 reporting systems and processes. On December 6, 2022, CMS presented a webinar on Section 111 reminders and best practice, additional resources and allowed for an open question and answer session. CMS stressed that accurate Section 111 reporting of TPOCs and ORM assists CMS and their contractors with accurate recovery.

CMS discussed how to calculate the TPOC and what is included with specific focus on the fact that indemnity only settlements do not get reported. Logically, this makes sense because the injured Medicare beneficiary is not being compensated for medical damages, and as such, the indemnity only settlement is not reportable because CMS cannot assert a recovery claim for conditional payments against an indemnity only settlement.

CMS also discussed the Event Table contained in Section 6.6.4 of Chapter 4 of the NGHP User Guide for Section 111 reporting. This Event Table can be useful to reporting entities when trying to determine when, what and how to report a particular beneficiary and their claim data. It covers a wide array of event scenarios and CMS reviewed two common issues and reviewed the appropriate action per the User Guide. The second scenario CMS reviewed is as follows:

ORM ends for one body part due to TPOC, but ORM continues for another body part for the same claim. The recommended action for this scenario is to send an update record for the open ORM report (Action Type 2) and remove the diagnoses codes for the body parts that have settled. Then the reporting entity should send an Add record to report the TPOC for the body part that settled.

The solution proposed by CMS is logical if you are working in a system where this is something that is possible. For example, what if the RRE has their TPA reporting their claims for them and the only way to submit an “Add” record in this scenario is to open a new claim for which the RRE will be charged a fee by the TPA. There are a lot of RREs that are unable to open multiple claims in their systems when all of the action for the claim is really under one claim/policy number in their system. As such, The Medicare Secondary Payer Network (MSPN) has been discussing possible solutions to this issue that will allow CMS to obtain the information that they need for recovery efforts and that will allow the RREs to do the reporting accurately without having to open additional claims to report multiple TPOCs and/or ORM timeframes for different body parts/injuries.

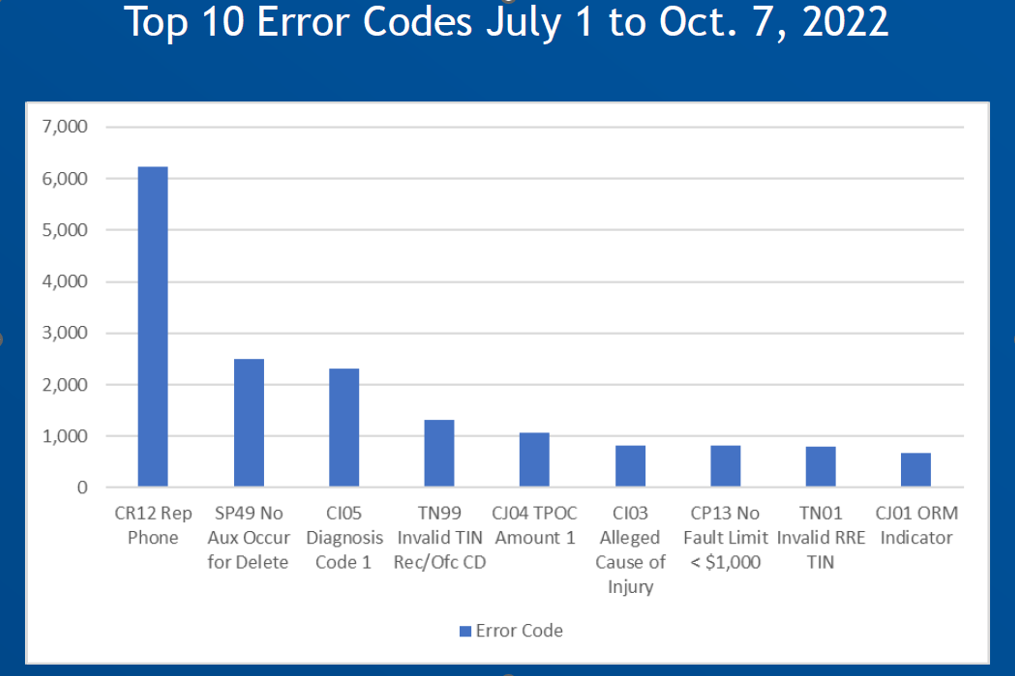

CMS also released the top 10 error codes that they have received from July 1, 2022 through October 7, 2022. This data was very interesting, and RREs should pay particularly close attention to this data.

The current proposed regulations for Section 111 Civil Monetary Penalties provide that one of the ways that an RRE can be penalized is for exceeding an error tolerance threshold. Specifically, if an RRE exceeds error tolerance thresholds established by the Secretary in any 4 out of 8 consecutive reporting periods they may be penalized. The proposed rules provide that the initial and maximum error tolerance threshold would be 20 percent (representing errors that prevent 20 percent or more of the beneficiary records from being processed), with any reduction in that tolerance to be published for notice and comment in advance of implementation. This undoubtedly will be the easiest way for CMS to find and assess penalties as it does not require the government to analyze or investigate if time frames have been missed, if claims haven’t been reported, or if conflicting information has been provided.

As such, if you are analyzing where to start for purposes of cleaning up your data, this is the logical first step. If you would like to analyze your data but don’t know where to start, please reach out to info@allankoba.com.

CMS opened 2023 with a series of updates to the NGHP Section 111 User Guide. First, on January 9, a new version of the User Guide – version 7.0 – was published. While several of the updates contained in this new iteration were informative only, including confirmation that the $750 settlement threshold will stay the same, and updates regarding soft edits; the most interesting update was perhaps the addition of the NGHP Unsolicited Response File. Beginning July 2023, RREs will have the ability to opt in (via the Section 111 portal – COBSW) to receive a monthly response file providing information regarding updates to ORM records (not made by the RRE) submitted within the last 12 months and permit RREs with the option to either update their own data or submit a request for a correction.

Table 7.3 of Ch. IV outlines the changes that may have been made to a record, as well as the response codes that indicate the type of unsolicited modification that has been made to the record. Table 7.3 can be found here – https://www.cms.gov/files/document/mmsea-111-january-9-2023-nghp-user-guide-version-70-chapter-iv-technical-information.pdf-0.

Shortly after the publication of Version 7.0, two quick edits followed – one addition, and one redaction.

These changes issued on 2/1 and 2/3 respectively simply clarified the fields that would be provided on the Unsolicited Response file.

Over the last two years, RREs have seen a spike in correspondence received from CMS indicating that information regarding ORM on file conflicts with other information received. At times, identifying the source of the conflicting information, and then correcting the file as needed has been very work intensive. Opting in to the Unsolicited Response file should give RREs some much needed assistance in identifying the source of any changes made to an ORM record, and then updating and/or correcting the Section 111 reporting as needed.

Each chapter of the updated User Guide, Version 7.0 is available for download here – https://www.cms.gov/medicare/coordination-of-benefits-and-recovery/mandatory-insurer-reporting-for-non-group-health-plans/nghp-user-guide/nghp-user-guide.

Don’t hesitate to contact Allan Koba Compliance Solutions with any questions about these updates as well as general inquiries regarding your Section 111 Reporting program at info@allankoba.com.

On November 14, 2022, CMS released version 3.8 of the WCMSA Reference Guide. If you attended the Medicare Secondary Payer Network 2022 Annual Conference (The National Medicare Secondary Payer Network) in September, you may have been anxiously anticipating the release of this updated guide with the hope that clarification on re-review requests would be provided as CMS agency officials discussed these changes would be coming soon. Christmas has come early as CMS has provided clarification on re-review requests and made some changes. Specifically, CMS has added a new category entitled “Submission Error”. Submitters may not submit re-review requests where the documentation originally submitted contained errors that resulted in a discrepancy in pricing of no less than $2,500. This new category and specific guidelines surrounding the same can be found in Section 16.1 and 16.2 of the WCMSA Reference Guide.

Section 16.1 and 16.2 provide (emphasis added):

16.1 Re-Review

When CMS does not believe that a proposed set-aside adequately protects Medicare’s interests, and thus makes a determination of a different amount than originally proposed, there is no formal appeals process. However, there are several other options available. First, the claimant may provide the WCRC with additional documentation in order to justify the original proposal amount. If the additional information does not convince the WCRC to change the originally submitted WCMSA amount and the parties proceed to settle the case despite the lack of change, then Medicare will not recognize the settlement. Medicare will exclude its payments for the medical expenses related to the injury or illness until WC settlement funds expended for services otherwise reimbursable by Medicare use up the entire settlement. Thereafter, when Medicare denies a particular beneficiary’s claim, the beneficiary may appeal that particular claim denial through Medicare’s regular administrative appeals process. Information on applicable appeal rights is provided at the time of each claim denial as part of the explanation of benefits.

A request for re-review may be submitted based one of the following:

16.2 Re-Review Limitations

If you have questions about these changes or would like to explore requesting re-review on a previously submitted case, please contact info@allankoba.com and a member of our team would be happy to assist.

Following the release of the updated Workers’ Compensation Medicare Set-Aside Arrangement (WCMSA) Reference Guide, Version 3.5, dated January 10, 2022, we have been waiting for CMS to announce a webinar to discuss the clarification on use of non-CMS approved products to address future medical care that this updated guide contained. According to the Webinar Announcement posted by CMS, additional topics will also be discussed including a summary of what is new in MSAs, addressing questions related to the inclusion of treatment, application of state rules, re-reviews/amended reviews and MORE!

A live Q&A session will follow CMS’s presentation so get your questions ready and tune in on Thursday, February 17, 2022 at 1:00PM EST. The webinar link and conference line information is listed below:

Allan Koba Compliance Solutions will be hosting a series of Webinars this year as well to discuss MSAs, conditional payments, Section 111 and more. Stay tuned for dates and registration information and don’t hesitate to reach out to info@allankoba.com for all your MSP Compliance needs.

CMS will now provide RREs, as well as their Recovery Agents, with the option to go paperless with respect to Medicare recovery correspondence. In an updated NGHP Section 111 User Guide release, version 6.7, CMS states that insurers and their recovery agents may elect to receive electronic correspondence so long as a Medicare Secondary Payer Portal (MSPRP) account has been set up. In order to opt into the Go Paperless option, the RRE can set certain indicators on its TIN Reference File and submit via Section 111 Reporting. It is important to note that the updated User Guide outlines the fact that the TIN Reference File has been extended, adding additional fields which will permit submitters to elect paperless for the RRE and for the established recovery agent.

Version 6.7 of the NGHP User Guide can be found here https://www.cms.gov/Medicare/Coordination-of-Benefits-and-Recovery/Mandatory-Insurer-Reporting-For-Non-Group-Health-Plans/NGHP-User-Guide/NGHP-User-Guide. Specifically, the updated User Guide details the Go Paperless addition in both Ch. IV and Ch. V. In full, the update provided in Ch. V states:

“When there is an active Medicare Secondary Payer Recovery Portal (MSPRP) account for the insurer/recovery agent TIN, Section 111 submitters may set Go Paperless options (i.e., choose to receive letters electronically or by mail) for the insurer and recovery agent address using the following new TIN Reference File fields:

Note- there are five new fields (fields 48-52) returned for these entries on the TIN Reference Response Fil3.

While this program is optional, making the switch to electronic correspondence may be a welcomed change. Not only does electronic delivery help to streamline the receipt and processing of recovery correspondence, but it can also alleviate concerns over postal service delays, address mix ups, and delivery failures, providing you more time to respond to demands, treasury notices, and other letters which require a timely response.

For questions about this update and whether the new Go Paperless option is right for you, as well as general inquiries about Section 111 reporting and Medicare recovery correspondence, please contact us at info@allankoba.com.