Author: Ciara Koba, Esq.

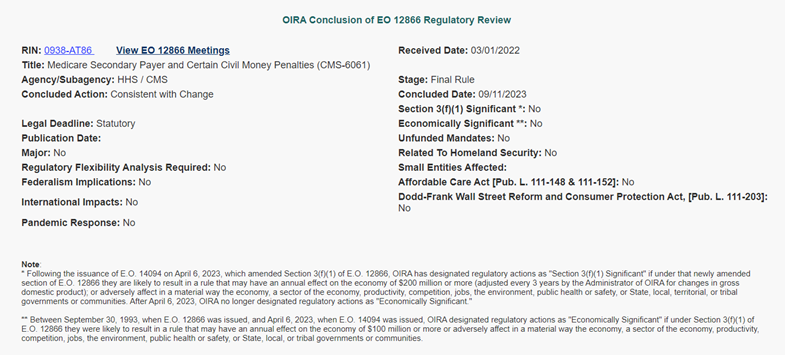

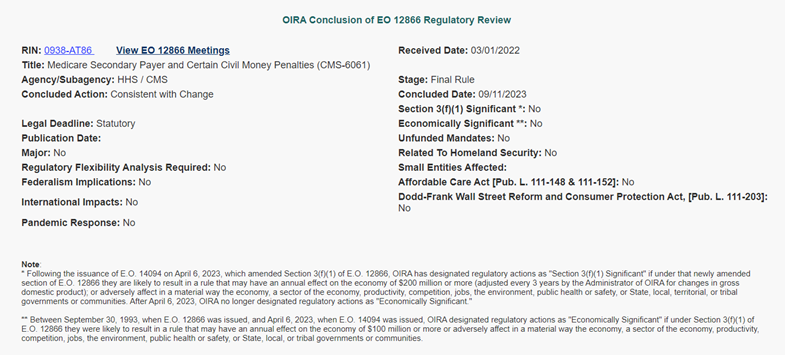

On Friday, September 22nd, the White House Office of Management and Budget published a notice (see image below) indicating the review of the Medicare Secondary Payer (MSP) Section 111 Reporting Civil Monetary Penalty Final Rule has been completed. As such, it is likely that the final rule will be published in the Federal Register very soon.

The MSP industry has been waiting for years to have more concrete regulatory guidance on what constitutes a failure to comply with the Section 111 Reporting rules such that a civil monetary penalty would be assessed. According to the updated notice, the final rulemaking was concluded on September 11, 2023. Further, it was also noted that the rule has been deemed to be not economically significant.

Given the current political climate, it is likely that we may see a delay in the promulgation of this final rule if the government does in fact shut down. That being said, we expect that the final rule will be published in the next few days/weeks.

If you have any questions about the civil monetary penalties or Section 111 reporting compliance in general, please reach out to info@allankoba.com.

Author: Logan Pry, Esq.

In a recent publication, the U.S. Attorney’s Office for the District of Maryland has confirmed that a Baltimore-based firm – Kandel & Associates, P.A. has entered into a settlement agreement to resolve alleged claims that the firm failed to reimburse Medicare for conditional payments made by CMS on behalf of firm clients. The claims against Kandel allege that over several years, the firm received settlement proceeds on behalf of its clients but neither the firm nor its clients reimbursed Medicare for conditional payments. The USAO has identified at least twelve Medicare liens that went unresolved.

The firm has agreed to pay $39,828.66 in order to resolve these matters and in addition to the monetary provision of this agreement, Kandel has agreed to designate a liaison within its office responsible for identifying and paying outstanding conditional payments on a timely basis. In addition, the liaison must also conduct periodic reviews for any outstanding Medicare liens and resolve as applicable.

The full press release issued by the U.S. Attorney’s Office for the District of Maryland can be found here – https://www.justice.gov/usao-md/pr/maryland-law-firm-kandel-associates-pa-agrees-pay-united-states-nearly-40000-settle

As the USAO notes in its publication, this settlement serves as a reminder that all parties to a claim must be aware of Medicare’s recovery rights and the independent obligations to reimburse Medicare for conditional payments. These obligations are not unique to carriers and employers. Of interest, the Federal Regulations governing this recovery right distinctly provide that CMS has a direct right of action to recovery from any primary payer, and further, may recover from any entity including a beneficiary, provider, supplier, physician, attorney, state agency, or private insurer that has received primary payment. See generally 42 CFR §411.24.

This settlement is not the first of its kind. Over the last few years, we have seen similar settlements between the DOJ and Plaintiff firms including a 2018 settlement in the Eastern District of Pennsylvania (Rosenbaum) and a 2020 settlement in the Middle District of Pennsylvania (Angino). This speaks to the growing recovery effort of not only CMS and the DOJ, but also Medicare Advantage plans in light of the PAID Act, as well as independent recovery firms with assignment rights.

Initiating conditional payment investigations into all applicable Medicare plans prior to entering into a settlement agreement and ensuring your release language is clear, encompassing, and protective of your interest can be key in avoiding any of the pitfalls described above. Please don’t hesitate to contact us with any questions regarding Medicare conditional payments and reimbursement rights at info@allankoba.com.

Author: Michelle Allan, Esq., CMSP

As what remains of 2022 dwindles into a new year, trending on the Medicare Conditional Payment front garners attention from industry stakeholders. Mounting concerns surrounding Civil Monetary Penalties associated with Section 111 Medicare Mandatory Insurer reporting (rulemaking anticipated by or before February 2023) could increase vigilance and reporting efforts. Additionally, a recent OIG audit, which coupled with procurement for various contractor positions administering the Medicare Secondary Payer program, pose changes for the last quarter of 2022 and into 2023.

OIG Audit

If you thought Medicare’s collection efforts have been aggressive in the past, a recent governmental report could incent the Agency to find even more money paid out by Medicare.

The Medicare Secondary Payer law exists to ensure that Medicare isn’t making payment when other insurance should, such as workers’ compensation insurance or liability insurance in the event of a motor vehicle accident or other event causing bodily injury.

Since 1980, Congress has granted Medicare status as a secondary payer in these instances, also equipping the Agency with powerful authority to seek reimbursement to the extent that it can even assert double damages against payers failing to reimburse the Medicare Trust.

But a recent government accountability report suggests that current recovery efforts aren’t fulfilling the demand.

On July 25, 2022, The U.S. Department of Health and Human Services Office of Inspector General published findings based on 148 Medicare audit reports issued during a 27-month period from October 1, 2014, through December 31, 2016, essentially summating that CMS was collecting just over half of the $498 million identified as overpayments.

These types of federal government audits provide oversight on Medicare’s recovery efforts to ensure the fiscal integrity of the Medicare Trust is intact. Research suggests the life expectancy of this health insurance program to be dwindling with revenues sufficient to cover operating costs through only 2028 for Part A Hospital insurance. Although the program is not expected to disintegrate in 2029, without additional revenues, the program will begin to experience shortfalls that could lead to delays and/or denials in payments among other issues.

This most recent audit was conducted as a follow-up to a study spanning a 30-month period ending in March of 2009. A prior study revealed that Medicare had not recovered $332 million of the $416 million believed to be overpayments at that time. OIG findings and recommendations predicated on the most recent audit include the following:

According to the report, CMS concurred with OIG’s recommendation to continue its efforts to recovery any collectible portion of the $226 million in uncollected overpayments.

While this study poses myriad downstream impacts to the MSP stakeholder community in terms of more aggressive recovery efforts, potentially the most concerning finding from OIG is the recommendation to make revisions to popular regulations allowing payers the ability to engage in ongoing appeals of conditional payment amounts the government attempts to collect. Proposed revisions to this series of regulations could alter the timeframes currently available for insurance companies and other payers, narrowing the window of opportunity currently available to file appeals when conditional payment amounts are not owed by the payer.

Procurement

At least two government contractors administering tasks espoused within Medicare Secondary Payer obligations are in procurement, raising the possibility that new contractors could enter the stage in the coming months.

The first contract is that for the Workers’ Compensation Review Contractor, which has historically been tasked with review of Workers’ Compensation Medicare Set-Asides submitted by settling parties to ensure that settlement dollars are earmarked for future claim-related medical treatment so that Medicare will not be asked to foot medical bills down the road. The RFP for this contract has expanded to include review and processing of other Non-Group Health Plan allocation reports, which likely references liability or no-fault Medicare Set-Asides. The industry has braced in a holding pattern for more than a decade in anticipation of rules and guidance surrounding MSAs and submissions set forth by Medicare for liability and no-fault insurance lines, expecting something akin to the existing guidance for Workers’ Compensation Medicare Set-Asides published and circulated by the Agency. A proposed rule currently sits with The White House on the desk of the Office of Management and Budget’s Office of Information and Regulatory Affairs, awaiting final review and publication.

The RFP for the WCRC position anticipates an award date of November 14, 2022. Historically, a change in contractor for this job results in some shuffling about with new personnel, potentially slowing down operations for a spell until the new folks are up and running. The WCRC reviewed approximately 1,600 MSAs per month in 2022 and 1,400 in 2021.

The Commercial Repayment Center, the contractor managing conditional payments specific to workers’ compensation claims, is facing contract expiration. Performant was awarded this contract in 2017, originally held by CGI when the CRC came into existence. The CRC was created in 2015 to work in tandem with the Benefits Coordination and Recovery Center, which managed liability conditional payments. Performant will be completing the fifth year of its five year contract at the conclusion of 2022. Changes surrounding a new CRC have included in the past alterations in the timeframes of correspondence and varying degrees of aggressiveness in collections efforts.

Allan Koba Compliance Solutions continuously monitors industry trends. We offer a full suite of Medicare Secondary Payer services, including Medicare Set-Asides, Medicare Conditional Payment resolution and Section 111 reporting and consulting. For additional information please contact info@allankoba.com.

*Corrective action recommendations published May 18, 2012 included (1) pursuit of legislation to extend the status of limitations so that the recovery period exceeds the reopening period for Medicare payments, (2) ensure its Audit Tracking and Reporting System (ATARS) is updated, (3) ensure CMS collections information is consisted with ATARS, (4) collect amounts made after audit period to the extent the law allows, (5) verify the collected amounts are accurate, and (6) provide specific guidance to contractors about collections.

Author: Melanie Schafer, Compliance Manager

Double the Damages, Double the Motion, Double the Denial: MSP Double Damages action to continue despite SoL and settlement release arguments

The United States District Court for the District of New Jersey in Osterbye v. United States, 2020 U.S. Dist. LEXIS 116591 (June 30, 2020) recently denied a carrier’s Motion to Dismiss claims arising under the MSP for double damages. The Motion was brought on two grounds: a statute of limitations argument and an argument based on release of claims in settlement. The Court dismissed both arguments, finding factual discrepancies sufficient to surmount a 12(b)(6) Motion to Dismiss.

Both the facts of the Complaint and the facts of the Motion denial merit further unspooling. The facts giving rise to the suit originate in a 2009 liability claim involving Anna May Osterbye and a plumbing contractor. Subsequent to suit but prior to settlement, Anna May Osterbye died, and settlement was effectuated on April 29, 2013, by her estate. A $13,562.90 Medicare conditional payment was known at the time of settlement, incorporated in the settlement, and paid post-settlement by the Plaintiffs, the Administrator of and the Estate of Anna May Osterbye.

Subsequent to settlement, CMS asserted a demand under a separate case control number for $118,071.28 which becomes the subject of the double damages claim. When apprised of the $118,071.28 demand, Plaintiffs appealed and lost on all lower levels. Of note, Plaintiffs had apprised CMS of decedent’s death on December 3, 2013, and provided a new Proof of Representation and an Executor Short Certificate that date. Despite the fact that settlement was effectuated by the estate and CMS was apprised of decedent’s death and provided the requisite documentation regarding same, an appeal to MAC on October 26, 2015, was denied on June 26, 2019, for lack of standing because of the death of the decedent. The available legal filings do not include any response of the agency prior to June 26, 2019, regarding standing issues based on the death of the beneficiary, despite Notice being tendered to the agency at the latest in December of 2013.

Having exhausted all administrative remedies, Plaintiffs in the instant case then brought suit against the United States and the carrier under the MSP’s private cause of action provision. The complaint relies on six claims:

The Plaintiffs and federal defendants stipulated to a dismissal of claims with prejudice, leaving the carrier the sole defendant in the case. Yet again, constitutional questions have been raised regarding the MSP and yet again have not been brought before a finder of fact to adjudicate.

Thereafter, the carrier brought a Motion to Dismiss before the district court on two grounds: that the MSP claim is time-barred because Medicare sent its final conditional payment letter on June 5, 2013, and Plaintiffs failed to sue the carrier within six years, and that the settlement language insulates the carrier from suit by the Plaintiffs.

The Court was unpersuaded by the carrier’s argument. On the first grounds—the statute of limitations—Plaintiff rejoined that the MSP does not contain a statute of limitations, and even if it did, it was equitably tolled because the Plaintiffs were first required to exhaust all administrative remedies through Medicare before filing in federal court. The carrier argued there is no exhaustion requirement. The Court was therefore presented with two questions: whether a Plaintiff must exhaust administrative remedies with Medicare prior to initiating suit under the private cause of action provision of the MSA; and what statute of limitations is applicable to the MSP’s private cause of action provision.

The Court found that where a claim is “rooted in, and derived from, the Medicare Act,” that “claim arises under the MSP and Plaintiffs are required to exhaust administrative remedies before seeking judicial review.” Osterbye, 5. The Court found that the standing and subjective basis for the claim in the instant case was “rooted in and derived from” the MSP such that they were required to exhaust administrative remedies before suing the carrier. Because Plaintiffs did not exhaust administrative remedies until June 26, 2019, and filed suit shortly thereafter, they were not time-barred from suing the carrier. The court declined to adopt a bright-line rule involving the MSP statute of limitations more generally; because the Plaintiffs were required to exhaust all administrative remedies and sued shortly thereafter, the question of a statute of limitations was not taken up by the Court.

For the second ground for its Motion to Dismiss, the carrier relied on the April 29, 2013, Release, pursuant to which Plaintiffs “release[d] and g[a]ve up any and all claims and rights which [Plaintiffs] may have against [the plumbing contractor.]” Osterbye, quoting the Release, unavailable for review. Plaintiffs also “agree[d] that [they] will not seek anything further, including any other payment.” Id. The carrier argued that such language insulated it from suit under the MSP’s private cause of action. Plaintiffs responded that the original Release was predicated on the $13,562.90 conditional payment, not the additional lien amount, and that the Release was therefore based on a “critical mistake of fact.” Osterbye, 10, quoting Plaintiff’s Opposition Brief, 9. The Court relied on the doctrine of mutual mistake, which is a question of fact for a finder of fact and which spoils any motion for summary judgment. The court therefore denied the Motion to Dismiss.

Given the legal standards which apply to 12(b)(6) Motions to Dismiss, it is important not to extend the findings of the Court too broadly: the Court did not rule that an allegation that the settlement was based on known damages nullifies the Release language per se. The Court instead found that the allegation of mutual mistake sufficiently spoiled a Motion to Dismiss, which by its nature requires the defendant to show that no claim has been presented. It will be for the trial court, should the case proceed to trial, to determine whether or not the instant Release language may sufficiently insulate the carrier from suit under the MSP’s private cause of action. Until that time, Release language indemnifying and holding a carrier harmless may not be sufficient grounds for claim dismissal, as such language may present a question of fact best left for a finder of fact to decide.